gorodkair.ru

Categories

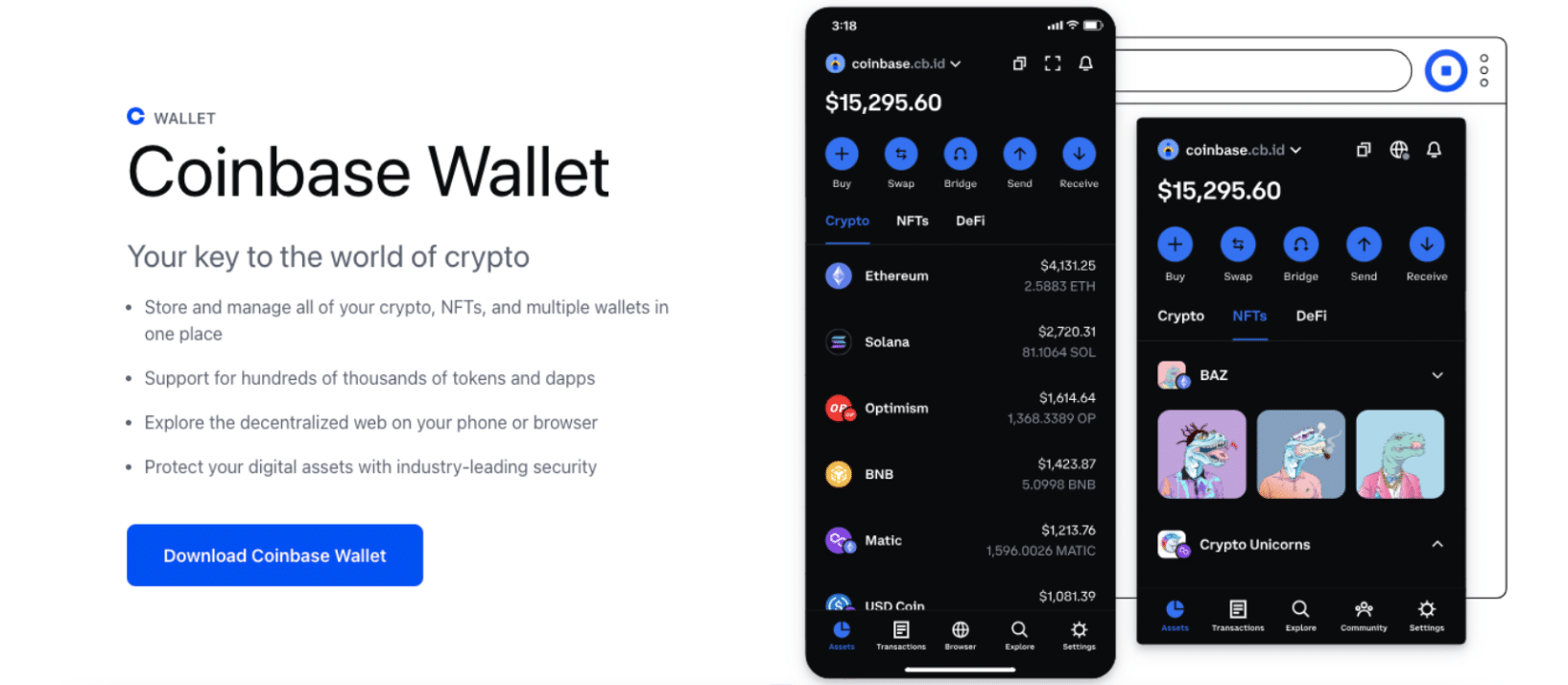

What Coins Does Coinbase Wallet Support

Coinbase Wallet supports crypto-to-crypto swaps for assets hosted on Ethereum, Base, BNB chain, Avalanche C-Chain, Polygon, and Optimism. You can swap to. Export your public addresses & xPubs from Coinbase Wallet to add supported chains to CoinTracker, including Arbitrum, Avalanche, Base, Bitcoin, BNB Chain. Supported Cryptocurrencies · Bitcoin · Ethereum · Bitcoin Cash · XRP · Stellar · Litecoin · 0x · Ethereum Tokens ETH Tokens. Since the asset isn't supported on the network you used, the funds did not arrive in your Coinbase account, and, unfortunately, we don't have. Top Crypto Assets ; 1. Bitcoin (BTC) Bitcoin BTC ; 2. Lightning Network (LNBTC) Lightning Network LNBTC ; 3. Ethereum (ETH) ETH network--drop1 Ethereum (ETH) ETH. Trezor cold wallets support Bitcoin and the most resilient and proven crypto worldwide. Check supported coins now. Coinbase Wallet supports thousands of coins on a number of blockchains, including Ethereum, Polygon, Avalanche, BNB Chain and Stellar Lumens. You can send or. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs, DeFi activity, and digital assets. SUPPORTED ASSETS. What coins are supported by Coinbase Wallet? Coinbase Wallet supports thousands of coins and tokens, including Ethereum and all ERC tokens. Does Coinbase. Coinbase Wallet supports crypto-to-crypto swaps for assets hosted on Ethereum, Base, BNB chain, Avalanche C-Chain, Polygon, and Optimism. You can swap to. Export your public addresses & xPubs from Coinbase Wallet to add supported chains to CoinTracker, including Arbitrum, Avalanche, Base, Bitcoin, BNB Chain. Supported Cryptocurrencies · Bitcoin · Ethereum · Bitcoin Cash · XRP · Stellar · Litecoin · 0x · Ethereum Tokens ETH Tokens. Since the asset isn't supported on the network you used, the funds did not arrive in your Coinbase account, and, unfortunately, we don't have. Top Crypto Assets ; 1. Bitcoin (BTC) Bitcoin BTC ; 2. Lightning Network (LNBTC) Lightning Network LNBTC ; 3. Ethereum (ETH) ETH network--drop1 Ethereum (ETH) ETH. Trezor cold wallets support Bitcoin and the most resilient and proven crypto worldwide. Check supported coins now. Coinbase Wallet supports thousands of coins on a number of blockchains, including Ethereum, Polygon, Avalanche, BNB Chain and Stellar Lumens. You can send or. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs, DeFi activity, and digital assets. SUPPORTED ASSETS. What coins are supported by Coinbase Wallet? Coinbase Wallet supports thousands of coins and tokens, including Ethereum and all ERC tokens. Does Coinbase.

Additionally, Coinbase Wallet supports Ethereum Layer-2 networks like Arbitrum, Avalanche C-Chain, BNB Chain, Fantom Opera, Optimism, Polygon. Which coins does Coinbase Wallet support? Coinbase Wallet supports a vast array of tokens, notably every ERC token as well as all assets on EVM-compatible. Download gorodkair.ru's multi-coin crypto wallet. A simple and secure way to buy, sell, trade, and use cryptocurrencies. Supports Bitcoin (BTC), Bitcoin Cash. Cryptocurrencies Available on Coinbase · Bitcoin (BTC) · Ethereum (ETH) · Tether USD (USDT) · Cardano (ADA) · Solana (SOL) · Polkadot (DOT) · USD Coin (USDC) · Dogecoin. Coins Supported by Coinbase Wallet ; BTC · LTC · ATOM · BSV ; · · · Coinbase Wallet allows you to transfer tokens to and from Layer 2 (L2) networks and sidechains such as Polygon, Arbitrum, and Base. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. The sun is setting on Onchain Summer, but does summer really need to end? Keep the energy alive by adding your creations to this gallery and minting your. Secure your crypto assets such as Bitcoin, Ethereum, XRP, Monero and more. Give yourself peace of mind by knowing that your cryptocurrencies are safe. Coinbase Prime supports more than digital assets and different trading pairs. Clients can also custody more than digital assets. Buy, sell, and store hundreds of cryptocurrencies. From Bitcoin to Dogecoin, we make it easy to buy and sell cryptocurrency. Protect your crypto with best in. What is Coinbase Wallet? As of January , Coinbase Wallet will no longer be supporting the following assets and networks due to low usage: BCH, ETC, XLM. Coinbase Wallet is a great option for self-custodying your cryptocurrency. Access to Multiple Cryptocurrencies: Bitcoin, Ethereum, and more supported. You can use Coinbase Wallet's 'Trade' feature to conduct decentralized token swaps on the Ethereum network, as well as Polygon, BNB Chain, and Avalanche. crypto depending on what you're trying to do. You might hear about, for instance, custodial wallets (like the wallet that comes with any Coinbase account). The Bottom Line: Why Choose Coinbase Wallet? · Supports cryptocurrency Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH), and ERC20 tokens, and ERC collectibles. Coinbase Wallet is a self-custody crypto wallet that puts you in control and unlocks the entire world of crypto Coinbase Wallet extension also supports. Supported networks and assets. The Coinbase Wallet browser extension supports Ethereum and Solana. does not support Solana or SPL tokens at this time. © Coinbase Wallet is a mobile crypto wallet providing access to a wide variety of crypto assets. The wallet supports Ethereum and ERC20 tokens.

What Do I Need To Get A Payday Advance

What is Required to Apply for a Payday Loan? · Government-issued photo ID · A cheque and/or pre-authorized debit form · A Bank Statement showing days from. The loan agreement is required to be in writing. The lender will not give you a payday loan unless you have a valid driver's license or other identification. Meet minimum age requirements (18 in most states); Valid ID; Proof of steady income; Open and active checking account; Working phone number. What do you need to. If you cannot afford to pay back the loan on the due date, do not take out a second payday loan to cover the cost. Doing so can lead to a cycle of debt which. To apply for a payday loan with Money Mart, you must be at least 18 years old, have a bank account, and be employed or have a steady source of income. How can I. How to qualify. At minimum, you'll need a checking account that shows: At least three recurring deposits; A total monthly deposit of at least $1, to unlock. To qualify for a loan, you must provide personal identification, proof of income, a bank statement and a personal check. In many states you can provide a debit. Yes. Having a bank account isn't universally required to borrow money, but lenders that don't require it generally charge high interest rates. This includes. Have your paystubs and ID handy! We will need to verify your income and identity when you apply for a Payday Loan. Here are some of the documents you might need. What is Required to Apply for a Payday Loan? · Government-issued photo ID · A cheque and/or pre-authorized debit form · A Bank Statement showing days from. The loan agreement is required to be in writing. The lender will not give you a payday loan unless you have a valid driver's license or other identification. Meet minimum age requirements (18 in most states); Valid ID; Proof of steady income; Open and active checking account; Working phone number. What do you need to. If you cannot afford to pay back the loan on the due date, do not take out a second payday loan to cover the cost. Doing so can lead to a cycle of debt which. To apply for a payday loan with Money Mart, you must be at least 18 years old, have a bank account, and be employed or have a steady source of income. How can I. How to qualify. At minimum, you'll need a checking account that shows: At least three recurring deposits; A total monthly deposit of at least $1, to unlock. To qualify for a loan, you must provide personal identification, proof of income, a bank statement and a personal check. In many states you can provide a debit. Yes. Having a bank account isn't universally required to borrow money, but lenders that don't require it generally charge high interest rates. This includes. Have your paystubs and ID handy! We will need to verify your income and identity when you apply for a Payday Loan. Here are some of the documents you might need.

LET'S TALK LOANS · 18 years or older- Steady income · Valid checking account- Active phone number · Valid government issued photo ID. For example, a day, $ payday loan with the maximum fee permitted by statute would have an APR of %. [Top]. Alerts, Resources & Publications. Payday. Payday loans are due in full on your next payday, typically in two weeks. If you aren't able to repay the loan that fast, as most borrowers aren't, you can get. Specifically, you must have the following equipment and software: A personal computer or other device which is capable of accessing the Internet. An Internet. Be at least 18 years of age · Have a contact phone number · Possess a valid government-issued photo ID · Have an active checking account and provide account. You will need to provide the following information: Open Chequing Account; Source of Income; ID Showing You're 18 or Older; Working Phone Number. If you don't. Payday loans are often internet-based and need access to a your bank account and personal information. Many internet-based payday lenders give little or no. You: · Are 18 years of age or older. · Have a valid, government-issued ID. · Have a valid and active email address, where applicable. · Provide proof of a steady. How do I qualify for a Payday Loan? Speedy Cash will process your application while taking into consideration your monthly income, credit score, and the. loan and repay it when you receive your next paycheck. By doing this you can get the funds you need from your next paycheck sooner. Payday Loans should be. Get payday, short-term loans & cash advance in Canada. % online. Cash with instant decision. No hidden fees. Perfect credit not required. You are not required to provide your Social Insurance Number to a payday lender. You should review the lender's privacy policy and make sure you understand it. Payday loans are limited to half (50%) of your take-home pay and only one loan is allowed at a time. Lenders need a copy of your pay stub and/or bank statement. All you need is a photo ID, a current bank statement and proof of income. A-1 Cash Advance will take care of the rest. In-store payday advance. Simply write a. How does the lender decide I can get a payday loan? · Your Social Security number (or other ID number if you do not have a Social Security number). · Information. It only takes a few minutes to get a payday loan with us. First off, fill out the application form. We'll need your basic details, including name, birthdate. Typically, all you need is to verify your identity and income. However, the tradeoffs include extremely high interest rates and fees, as well as short repayment. It is required by the majority of lenders that a person should have a valid checking account; otherwise, the money transfer will be complicated. However. YOU HAVE QUESTIONS · Recent bank statement from a valid checking account · Personal check from your checking account · Recent proof of steady income (e.g. pay. Payday lenders require you to furnish a copy of your driver's license, and information about your employment and bank accounts. The loan is usually for a couple.

Best Loans For First Time Homeowners

Are there home loans available for first-time homebuyers with low credit scores? · FHA loans from the Federal Housing Administration are aimed at low- to. There are a variety of financing options available to first-time homebuyers—including conventional mortgages and government-backed loans. The HCR Housing Choice Voucher (HCV) Homeownership Program helps first time homebuyers obtain and retain a home of their own by making monthly payments towards. first-time homebuyer You should shop around for homeowner's insurance for the best rates. If you are buying a home in a flood zone, you may be. Best mortgage lenders for first-time home buyers · Best places in the U.S. for first-time home buyers. Find first-time home buyer programs and lenders in your. You're the star of the show, so ask any and all questions, and expect a lot of communication as your lender and agent work to ensure your best interest comes. The loan programs below aren't limited to first-time homebuyers, but they can be a good option for those with small down payments or fair credit scores. My loan process wasn't any longer because of it, but also because I had good mortgage broker that was on top of things. So I would definitely. Review SONYMA loans to find the one that best fits your needs. SONYMA Programs SONYMA has two primary mortgage programs, Achieving the Dream and Low Interest. Are there home loans available for first-time homebuyers with low credit scores? · FHA loans from the Federal Housing Administration are aimed at low- to. There are a variety of financing options available to first-time homebuyers—including conventional mortgages and government-backed loans. The HCR Housing Choice Voucher (HCV) Homeownership Program helps first time homebuyers obtain and retain a home of their own by making monthly payments towards. first-time homebuyer You should shop around for homeowner's insurance for the best rates. If you are buying a home in a flood zone, you may be. Best mortgage lenders for first-time home buyers · Best places in the U.S. for first-time home buyers. Find first-time home buyer programs and lenders in your. You're the star of the show, so ask any and all questions, and expect a lot of communication as your lender and agent work to ensure your best interest comes. The loan programs below aren't limited to first-time homebuyers, but they can be a good option for those with small down payments or fair credit scores. My loan process wasn't any longer because of it, but also because I had good mortgage broker that was on top of things. So I would definitely. Review SONYMA loans to find the one that best fits your needs. SONYMA Programs SONYMA has two primary mortgage programs, Achieving the Dream and Low Interest.

We help make homeownership possible. You may qualify for a home loan with as little as 3% down with our Standard Agency or Dreamaker. The MI Home Loan program is a mortgage product that is available to first-time homebuyers state-wide and repeat homebuyers in targeted areas. Down Payment Assistance - Most Great Choice Home Loans are insured by FHA or USDA-RD, which means you may be eligible to borrow up to % of the total. Homebuying programs in your state · Let FHA help you (FHA loan programs offer lower downpayments and are a good option for first-time homebuyers!) · HUD's special. Best mortgage lenders for first-time home buyers · Best places in the U.S. for first-time home buyers. Find first-time home buyer programs and lenders in your. The California Dream For All Shared Appreciation Loan is a down payment assistance program for first-time homebuyers to be used in conjunction with the Dream. To qualify, the buyer must obtain a fixed-rate first trust deed loan; have adequate income, a good credit rating; and provide a minimum down payment of 1. Best mortgage lenders for first-time home buyers · Best places in the U.S. for first-time home buyers. Find first-time home buyer programs and lenders in your. Downpayment Assistance Need help with a downpayment? · Home Advantage DPA Needs Based Option Up to $10,, for borrowers using our Home Advantage loan and under. The HomeFirst Down Payment Assistance Program provides qualified first-time homebuyers with up to $, toward the down payment or closing costs on a Offered by over 40 lenders, ONE is the state's most affordable mortgage for low- and moderate-income first-time homebuyers. Top-requested sites to log in to. Best of the Best. Related Articles. Featured. SD Housing Ready To Buy? Available Programs · First-Time Homebuyers · Repeat Homebuyer · Downpayment Assistance. Are You A First-Time Home Buyer? If you are buying your first home, you can also apply for a mortgage interest tax credit known as a Mortgage Credit. Florida Housing offers a Homebuyer Program that offers year fixed rate first mortgage loans to first time homebuyers through participating lenders. KHRC helps enable the dream of homeownership through offering first-time buyers assistance with down payment and closing costs. Attend a homebuyer education course if you are a first-time homebuyer. · ONLINE: You can take eHome's eight-hour Homebuyer Education course online (fee: $99) · IN. Our NC Home Advantage Mortgage™ offers down payment assistance up to 3% of the loan amount that can help first-time and move-up buyers get into a new home. About HomeFirst. The HomeFirst Down Payment Assistance Program provides qualified first-time homebuyers with up to $, toward the down payment or. Home Loan Programs MMP home loans are available as either Government or Conventional insured loans. Government loans can be guaranteed by the Federal Housing. Best mortgage lenders · Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination.

Pay Off Loan Or Credit Card

If you're paying more for your borrowing than you're getting on your savings, it makes sense to pay off your loans, credit or store cards – as long as you can. Unlike a personal loan, with a credit card, you pay interest only on the funds you use. And if your credit card has a grace period, as cards typically do for. Answer: Maybe. Here are some steps for researching and comparing credit cards and loan rates to decide if this is the right option for you. The new challenge is deciding what to do with it: paying down debt first or putting it in a savings account. The right answer depends on your circumstances and. How do I pay off credit card debt? · Start by understanding your finances: Work out your monthly budget and follow it · Add a rainy-day fund to your budget · Set. Check your rate in 5 minutes. · Get funded in as fast as 1 business day. · Combine multiple bills into 1 fixed monthly payment. · Why choose Upstart for credit. The core question to answer is whether you will pay less interest when you pay down a loan with a credit card, or whether you'll end up paying more. One method to consider is taking out a personal loan (ideally with a lower rate than you're paying on your credit cards) and using the funds to pay off your. Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when. If you're paying more for your borrowing than you're getting on your savings, it makes sense to pay off your loans, credit or store cards – as long as you can. Unlike a personal loan, with a credit card, you pay interest only on the funds you use. And if your credit card has a grace period, as cards typically do for. Answer: Maybe. Here are some steps for researching and comparing credit cards and loan rates to decide if this is the right option for you. The new challenge is deciding what to do with it: paying down debt first or putting it in a savings account. The right answer depends on your circumstances and. How do I pay off credit card debt? · Start by understanding your finances: Work out your monthly budget and follow it · Add a rainy-day fund to your budget · Set. Check your rate in 5 minutes. · Get funded in as fast as 1 business day. · Combine multiple bills into 1 fixed monthly payment. · Why choose Upstart for credit. The core question to answer is whether you will pay less interest when you pay down a loan with a credit card, or whether you'll end up paying more. One method to consider is taking out a personal loan (ideally with a lower rate than you're paying on your credit cards) and using the funds to pay off your. Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when.

If you're paying more for your borrowing than you're getting on your savings, it makes sense to pay off your loans, credit or store cards – as long as you can. By paying your debt shortly after it's charged, you can help prevent your credit utilization rate from rising above the preferred 30% mark and improve your. Experts tend to recommend one of two methods for paying off credit card debt: the debt snowball method or the debt avalanche method. So overall, whether an emergency happens or not, the best result is to pay off your credit card debts with your savings. The disciplined exception. Those making. If you pay off your credit card balance in full, for example, you'll save on interest charges. Generally, the longer you're stuck paying back a loan or other. With higher interest rates, it takes longer and costs more to pay off credit card debt as your balance continues to increase. loan can help establish credit. That's why you're better off eliminating all credit card debt before investing. Once you've paid off your credit cards, you can budget your money and begin to. Personal loans can be a great option for consolidating your credit card debt. As just noted, they typically offer lower interest rates. This credit card payoff strategy focuses on psychological factors like motivation and incentive to keep people on track towards paying off their credit card. A personal loan or a credit card can be a good option, depending on how much money you need and how quickly you can pay it back. Generally, personal loans are. These strategies can help you pay off your debt fast and avoid feeling overwhelmed. 1. Review and revise your budget. It could help you save money over the life of the loan with a competitive rate, putting you on a path to paying off debt. A credit card consolidation loan could. Paying off credit card debt can feel daunting. But with some research, an effective plan and consistency, you can get one step closer to paying off debt. Taking out a personal loan to pay off credit card debt is one option you have. In most cases, the process of debt consolidation is relatively easy. Seek professional financial advice: A credit counseling agency can help you pay down debt by creating a debt management plan. A credit counselor meets with you. If you have multiple credit card accounts, you need to develop a strategy to pay them off, which many people do by paying down on first. Some people use the. Personal loan is better option for managing cash flow in larger amounts for any circumstances; credit card would usually more viable for. You should focus on paying off credit cards with a high interest rate first. The longer you hold on to high-interest debt, the more interest you rack up. If you have applied for both personal loan and credit card, then it is your duty to pay both the EMIs on time. However, if you want to repay one. The bottom line is that in most cases, paying off credit card debt is a better financial move than paying extra towards student loans. However, as with most.

Popular Mens Bracelet

Men have a variety of bracelet styles to choose but in the last couple of years, the most popular bracelets for men are leather bracelets, Id bracelets in gold. Men's bracelets in gold, silver, titanium, and leather with meaning. Custom personalized designer bracelets, uniquely cool Bracelets for men. Men's Woven Box Chain Bracelet in Sterling Silver with Nylon, 10mm. $Current Price $ ; Men's Snake Chain Bracelet (Nordstrom Exclusive). $ Shop men's designer bracelets at Tiffany & Co. for bracelets in titanium, leather, 18k gold and sterling silver. Discover timeless and modern styles. Hundreds of different bracelets from us. Take a look at, for example, Sector's stylish bracelets suitable for men. You can also find men's bracelets at. JAXXON makes it easy to create signature statements with thoughtfully crafted luxury bracelets for men. Whether you choose to adorn your wrist with a gold chain. Step into your best fit with stainless steel magnetic closure bracelets, tan leather latch bracelets, stone bead bracelets, braided rope bracelets, timeless. Welcome to one of the UK's finest and most discerning collections of bracelets for men – Tateossian. Located in the heart of London, Tateossian's jewelry. Your bracelet must be proportional to your size and fit correctly. This boils down to wearing larger bracelets for thicker wrists and smaller for thin wrists. Men have a variety of bracelet styles to choose but in the last couple of years, the most popular bracelets for men are leather bracelets, Id bracelets in gold. Men's bracelets in gold, silver, titanium, and leather with meaning. Custom personalized designer bracelets, uniquely cool Bracelets for men. Men's Woven Box Chain Bracelet in Sterling Silver with Nylon, 10mm. $Current Price $ ; Men's Snake Chain Bracelet (Nordstrom Exclusive). $ Shop men's designer bracelets at Tiffany & Co. for bracelets in titanium, leather, 18k gold and sterling silver. Discover timeless and modern styles. Hundreds of different bracelets from us. Take a look at, for example, Sector's stylish bracelets suitable for men. You can also find men's bracelets at. JAXXON makes it easy to create signature statements with thoughtfully crafted luxury bracelets for men. Whether you choose to adorn your wrist with a gold chain. Step into your best fit with stainless steel magnetic closure bracelets, tan leather latch bracelets, stone bead bracelets, braided rope bracelets, timeless. Welcome to one of the UK's finest and most discerning collections of bracelets for men – Tateossian. Located in the heart of London, Tateossian's jewelry. Your bracelet must be proportional to your size and fit correctly. This boils down to wearing larger bracelets for thicker wrists and smaller for thin wrists.

Find expressive and sensual designer bracelets for men. Perfect for any outing, our bracelets offer unmatched style. Experience luxury with John Hardy®. Men's Bracelets: NOVICA, the Impact Marketplace, showcases hundreds of unique, limited edition men's bracelets in leather, silver and onyx. Popular bracelets, Cool bracelets, Mens chain bracelets Curb, Bracelet design for men, Stainless steel bracelets. Which length bracelet is best for men? This is entirely down to personal preference and choice. A lot of our bracelets for men come in only set lengths – these. Accessorize with men's designer bracelets. Sterling silver chain link bracelets or braided leather bracelets make for meaningful gifts. Popular bracelet trends for men include minimalist designs, such as simple metal cuffs or leather bands, which offer a sleek and versatile. Engraved Men's Bracelets. Though silver mens bracelets are the most popular request by shoppers, there are many different styles to choose. Designer Bracelets for Men · Emanuele Bicocchi multi-cross Avelli bracelet · Diesel Dx logo-plaque bracelet · Off-White Arrows-charm bracelet · Nialaya Jewelry. Men's Bracelet Onyx / Malachite Regular price $39 Buy 1 Get 1 FREE · 17 reviews. The meenakari men's Kada is another stunning design that gives a traditional look and feel. · The red coral Kada for men appears studded with. Elevate your style with our Best Bracelets for Men. From classic leather to rugged rope, find the perfect Men's Bracelets to complement your look. Shop now! Designer Bracelets at Saks: Discover new arrivals from today's top brands. Designers & modern jewellers - $$$ - many designer brands make mens jewellery, and chain bracelets are quite common. Keep in mind that if. With a variety of styles and materials, from wood to metal, Treehut's best bracelets for men cater to those who appreciate a casual look as well as those who. The most popular men's bracelet styles of reflect a diverse range of tastes and preferences, each offering a unique way to express individuality and. Men's Bracelets, Nialaya men's beaded bracelets are skillfully handcrafted in our Hollywood workshop. Our beaded bracelets for men features spiritual beads. Different Men's Bracelet Styles You'll Find at PuraVida. On this page, you'll find the most diverse selection online. Some of our more popular categories. At Fossil, we've spent decades perfecting the craft of creating the best mens bracelets that give you effortlessly cool style every time. Men's Leather. I've created this range of personalized men's bracelets in timeless, classic materials like leather, pewter, and sterling silver — materials that stand the. Men's Bracelets · Men's Bracelets · Sterling Silver and 6mm Lapis Beaded Bracelet · Sterling Silver and 6mm Black Onyx Beaded Bracelet · Sterling.

Present Home Mortgage Rates

Today's average year fixed-mortgage rate is , the average year fixed-mortgage rate is percent, and the average 5/1 ARM rate is percent. 3. The average rate predicted for was % while the actual average rate throughout the year was %. Industry experts can be that far off in relatively. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. After the loan term, your rate and monthly payment can change annually based on current interest rates during specified intervals following the initial fixed. Helpful mortgage rate details ; 30 Year Fixed Jumbo · % · % ; 30 Year Fixed Conforming · % · % ; 30 Yr 5/6 ARM Jumbo · % · % ; 30 Yr 5/6 ARM. Compare Current Mortgage Rates · Farmers Bank of Kansas City logo. Farmers Bank of Kansas City. NMLS # U.S. News Rating. Interest Rate: %. APR. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. Fixed mortgage rates held mostly steady this week at roughly month lows. Freddie Mac reported today that the average offered interest rate for a. Earlier this month, rates plunged and are now lingering just under percent, which has not been enough to motivate potential homebuyers. Rates likely will. Today's average year fixed-mortgage rate is , the average year fixed-mortgage rate is percent, and the average 5/1 ARM rate is percent. 3. The average rate predicted for was % while the actual average rate throughout the year was %. Industry experts can be that far off in relatively. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. After the loan term, your rate and monthly payment can change annually based on current interest rates during specified intervals following the initial fixed. Helpful mortgage rate details ; 30 Year Fixed Jumbo · % · % ; 30 Year Fixed Conforming · % · % ; 30 Yr 5/6 ARM Jumbo · % · % ; 30 Yr 5/6 ARM. Compare Current Mortgage Rates · Farmers Bank of Kansas City logo. Farmers Bank of Kansas City. NMLS # U.S. News Rating. Interest Rate: %. APR. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. Fixed mortgage rates held mostly steady this week at roughly month lows. Freddie Mac reported today that the average offered interest rate for a. Earlier this month, rates plunged and are now lingering just under percent, which has not been enough to motivate potential homebuyers. Rates likely will.

Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate.

Compare current mortgage rates. As of August 22, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the. View today's reverse mortgage interest rates & APR + read our 3 tips to help decide which interest rate is best for you! rate on a year mortgage is %. On a year jumbo mortgage, the average rate is %.Current Mortgage Rates for August 22, By Caroline Basile. After the initial fixed-rate period, your interest rate can increase every six months according to the market index. Current index (30 day avg SOFR) as of April. The current average year fixed mortgage rate remained stable at % on Friday, Zillow announced. The year fixed mortgage rate on August 23, is down. Deliver daily mortgage rates to your site visitors by creating a fully current or suitable for any particular purpose. In addition, this content is. home price, down payment, and more can affect mortgage interest rates These rates are current as of 8/20/ Explore what a lower interest rate. Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, %. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. A mortgage rate is the interest rate you pay on the money you borrow to buy property. Compare today's mortgage rates for purchase and refinance and lock in. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. What do the results mean? Results will show you a snapshot of mortgage rates and corresponding annual percentage rate (APR) for competitive programs that PNC. The direction they take will likely be determined by what Federal Reserve Chair Jerome Powell says in a speech he's set to deliver at 10 a.m. Eastern. Current. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, The average rate on a year fixed mortgage remained relatively stable at % as of August 22, marking its lowest level since mid-May , according to. Current Mortgage Rates in Canada: Compare Today's Top Offers ; 3 Year Variable Rate. Radius Financial Logo. Radius Financial. % ; 1 Year Fixed Rate. Ganaraska. Daily Rate Sheet ; 10 Year Fixed, %, %, $ 10 Year Fixed. Monthly payment estimates are based on single family, owner occupied, credit score. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more.

Deere & Company Stock

Over the last year, Deere & Company's stock price has decreased by %. Deere & Company is currently approximately $ per share. As of last trade, Deere & Co (DE:NYQ) traded at , % above the 52 week low of set on Aug 05, week range. Today. Aug 05 ; Volume: K · 65 Day Avg: M ; Day Range ; 52 Week Range DE Related stocks ; Deere & Company ; CNH, , % ; CNH Industrial N.V. ; AGCO, , %. Get the latest updates on Deere & Company Common Stock (DE) pre market trades, share volumes, and more. Make informed investments with Nasdaq. Managers and Directors: Deere & Company ; Clayton Jones BRD. Director/Board Member, 74 ; John May CEO. Chief Executive Officer, 54 ; Sherry Smith BRD. Director/. The Deere & Company stock price today is What Is the Stock Symbol for Deere & Company? The stock ticker symbol for Deere & Company is DE. Is DE the Same. Deere & Company (DE) ; Jul 19, , , , , ; Jul 18, , , , , The current price of DE is USD — it has increased by % in the past 24 hours. Watch Deere & Company stock price performance more closely on the chart. Over the last year, Deere & Company's stock price has decreased by %. Deere & Company is currently approximately $ per share. As of last trade, Deere & Co (DE:NYQ) traded at , % above the 52 week low of set on Aug 05, week range. Today. Aug 05 ; Volume: K · 65 Day Avg: M ; Day Range ; 52 Week Range DE Related stocks ; Deere & Company ; CNH, , % ; CNH Industrial N.V. ; AGCO, , %. Get the latest updates on Deere & Company Common Stock (DE) pre market trades, share volumes, and more. Make informed investments with Nasdaq. Managers and Directors: Deere & Company ; Clayton Jones BRD. Director/Board Member, 74 ; John May CEO. Chief Executive Officer, 54 ; Sherry Smith BRD. Director/. The Deere & Company stock price today is What Is the Stock Symbol for Deere & Company? The stock ticker symbol for Deere & Company is DE. Is DE the Same. Deere & Company (DE) ; Jul 19, , , , , ; Jul 18, , , , , The current price of DE is USD — it has increased by % in the past 24 hours. Watch Deere & Company stock price performance more closely on the chart.

Get the latest Deere & Co (DE) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. Analyst Forecast. According to 18 analysts, the average rating for DE stock is "Buy." The month stock price forecast is $, which is an increase of View Deere & Company DE stock quote prices, financial information, real-time forecasts, and company news from CNN. About Deere & Company (DE) ; Price / earnings ratio. x ; Yesterday's range. $ - $ ; Debt / equity. x ; 52 week range. $ - $ ; 5. Deere & Co DE:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/05/23 · 52 Week Low · DE Logo, Deere & Co (DE) Stock Price: $ (%). Stocks / DE Stock / Summary. Stocks. Company Description. Deere. Founded in , Illinois-based Deere & Co. manufactures and distributes various equipment that is used in agriculture. Discover real-time Deere & Company Common Stock (DE) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Deere & Company | DEStock Price | Live Quote | Historical Chart ; Toro, , , % ; United Rentals, , , %. The 59 analysts offering price forecasts for Deere have a median target of , with a high estimate of and a low estimate of The median. Deere & Company (NYSE: DE). $ (%). $ Price as of August 23, Deere & Company shares are traded on the New York Stock Exchange (NYSE) under the symbol DE. Does Deere & Company pay dividends? Deere & Co. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Deere NYSE:DE Stock Report ; Last Price. US$ ; Market Cap. US$b ; 7D. % ; 1Y. % ; Updated. 26 Aug, Deere & Company · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (+. Deere & Co DE ; Valuation · Price/Earnings (Normalized). , , ; Financial Strength · Quick Ratio. , , ; Profitability · Return on Assets . Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: Deere & Co. ; Nov, Reiterated, TD Cowen, Market Perform, $ → $ ; Sep, Downgrade, Canaccord Genuity, Buy → Hold, $ → $ Stock analysis for Deere & Co (DE:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Deere & Co (DE) Common Stock USD1 ; Trade low · $ ; Year low · $ ; Previous · $ ; Volume · n/a ; Dividend yield · %.

How Much Cost Full Coverage Insurance

Average rates for the best full-coverage. Cost of Full Coverage Insurance How much can you expect to pay for full coverage car insurance? Well, it depends on where you live, the type of vehicle you. $/Month for full coverage here. All insurance rates are disgusting right now, my car and home insurance both gone up significantly. How Much Is Car Insurance in Arizona? Full coverage car insurance in Arizona costs an average of $1, per year, while the state-required minimum liability. To start, there's no standard definition of "full coverage" for car insurance. Car insurance isn't a one-size-fits-all purchase and a car insurance policy. Understanding full coverage insurance. Many people search for the best rates on “full coverage” car insurance, but what does full coverage mean? The national average cost for full coverage car insurance is $2, per year, or $ per month. Drivers with minimum coverage pay an average of $ a year, or. The national average cost of car insurance in is roughly $ per year (or $64 per month). This average rate is for a minimum coverage policy. Many factors determine the cost, including where you live, your driving history, the year, make, and model of your car, the coverage limits you select, and your. Average rates for the best full-coverage. Cost of Full Coverage Insurance How much can you expect to pay for full coverage car insurance? Well, it depends on where you live, the type of vehicle you. $/Month for full coverage here. All insurance rates are disgusting right now, my car and home insurance both gone up significantly. How Much Is Car Insurance in Arizona? Full coverage car insurance in Arizona costs an average of $1, per year, while the state-required minimum liability. To start, there's no standard definition of "full coverage" for car insurance. Car insurance isn't a one-size-fits-all purchase and a car insurance policy. Understanding full coverage insurance. Many people search for the best rates on “full coverage” car insurance, but what does full coverage mean? The national average cost for full coverage car insurance is $2, per year, or $ per month. Drivers with minimum coverage pay an average of $ a year, or. The national average cost of car insurance in is roughly $ per year (or $64 per month). This average rate is for a minimum coverage policy. Many factors determine the cost, including where you live, your driving history, the year, make, and model of your car, the coverage limits you select, and your.

Use Allstate's car insurance calculator to estimate how much auto insurance coverage you may need and what it could cost. Full coverage insurance costs $1, per year or $ per month, on average. Full coverage car insurance is more expensive than the legal minimum auto insurance. Comprehensive insurance is optional coverage that protects you in the event To find out exactly how much auto insurance will cost you, speak to a. Keep in mind that accidents can be expensive, and the minimum coverage required may not be sufficient to cover your total costs from damage, injuries or. Our car insurance calculator factors in life changes such as marital status and homeownership to provide customized cost estimates and coverage suggestions. With today's costs for medical and automobile repair, California's low liability requirements may not cover the total amount due. Any injuries and liabilities. Your deductible; Your policy limit(s). So, how much does full coverage car insurance cost? The answer depends partially on you and your history. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month. By comparison, the national averages for liability-only and full-coverage car insurance are $ and $, respectively. Many areas of Texas are at risk of. When determining your rates, car insurance providers analyze much more than just your driving record and ZIP code. Their intricate algorithms also crunch. The cheapest companies for full coverage policies are USAA, Erie Insurance, and State Farm with average rates under $1, Raising your deductible, comparing. Generally speaking, the average cost is about $1, However, this number can only tell drivers so much because different states all have their own average car. How much would full coverage car insurance cost me? If you've been asking these questions, you're not alone. These are common inquiries among those searching. Comprehensive, Liability, and more. That's it. No strings attached. Trying to figure out how much car insurance will cost you? Get a free car insurance quote. The cost of having liability, collision and comprehensive coverage varies. Your driving record, car's value, location, deductible amounts and how much coverage. For a full car insurance cost estimate, get a car insurance quote today. How do you determine how much car insurance you need? To determine how much car. How much can I save on car insurance with Allstate? · Types of auto insurance coverage · Ways you can save on Allstate car insurance rates · Discounts & savings. Call us now at to get a quote as part of our goal to provide cheap full coverage Illinois car insurance. Full coverage typically costs more than minimum liability insurance; however, it may benefit drivers who want to avoid expensive out-of-pocket vehicle repairs. CALIFORNIA AUTO INSURANCE RATES BY COVERAGE LEVEL ; $50K/$K/$50K Bodily Injury/Property Damage — $ Comprehensive/Collision, $1, ; State Minimum —.

What Should I Do With 10000 In Savings

Most are FDIC and allow you to withdraw funds at any time. Money market account: A lower-risk option, this high-interest deposit account could grow your money. Use our savings calculator to find how much interest you will earn on your savings, or to calculate how long it will take to meet your savings goal. No. $10, is better than $0, and the person should be commended for the discipline for achieving that milestone. Keep Saving and it will be a. If you've taken the America Saves pledge, you've already chosen a savings goal which means you're ahead of the savings curve! 5. Save automatically. · Make a. The best way to do this is to find the highest interest rates you can for your money, balanced against the amount of access you need. Savings linked to bank. Optimizing your savings · Hold only the right amount of cash · Choose the right accounts · Use passive investing to maximize returns. Your best bet is in an online high-yield savings account, which pays more interest than a traditional savings account at your local brick-and-mortar bank. Saving for retirement might be the most important thing you ever do with your money. And the earlier you begin, the less money it will take! 4 minute read. If you've taken the America Saves pledge, you've already chosen a savings goal which means you're ahead of the savings curve! 5. Save automatically. · Make a. Most are FDIC and allow you to withdraw funds at any time. Money market account: A lower-risk option, this high-interest deposit account could grow your money. Use our savings calculator to find how much interest you will earn on your savings, or to calculate how long it will take to meet your savings goal. No. $10, is better than $0, and the person should be commended for the discipline for achieving that milestone. Keep Saving and it will be a. If you've taken the America Saves pledge, you've already chosen a savings goal which means you're ahead of the savings curve! 5. Save automatically. · Make a. The best way to do this is to find the highest interest rates you can for your money, balanced against the amount of access you need. Savings linked to bank. Optimizing your savings · Hold only the right amount of cash · Choose the right accounts · Use passive investing to maximize returns. Your best bet is in an online high-yield savings account, which pays more interest than a traditional savings account at your local brick-and-mortar bank. Saving for retirement might be the most important thing you ever do with your money. And the earlier you begin, the less money it will take! 4 minute read. If you've taken the America Saves pledge, you've already chosen a savings goal which means you're ahead of the savings curve! 5. Save automatically. · Make a.

Upping your saving just 1% may seem small, but after 20 or 30 years it can make a big difference in your total savings. For example, if you are in your 20s, a 1. If you put $10, into a high-yield savings account with a % APY, you'll make $ in interest in a year. If you deposit $10, into a high-yield. If I then have savings of £10, would the first £8, of that be within do a tax return for him for 23/ I have calculated that he earned. What is a savings account? · How do I open a savings account? · How does a savings account work? · How many savings accounts should I have? · Which savings account. Amounts up to $10, may be deposited, earning 10% interest annually. Members must be receiving Hostile Fire Pay and be deployed for at least 30 consecutive. Maintain a $10, minimum daily balance, link an eligible TD Checking account or open it as an IRA. Enjoy tiered APY rates: As your balance grows, so does your. MESP savings do not disqualify students from financial aid and count less How does a college savings plan compare to other college savings options? Build your emergency savings fund. Simply put, if you don't have an emergency fund yet, that's the first step you need to take in your investing journey. Park. There is no easy way to make money. Above-market rates with little or no risk do not exist. · Don't ignore that feeling in the pit of your stomach. · Don't invest. How do I open a joint savings account? Joint savings accounts must be opened at a branch. $10, to $24,; $25, to $49,; $50, to. SAVE TODAY FOR A BRIGHTER TOMORROW · BASIC SAVINGS. Open Account. A great basic savings account. Earn interest · SAVINGS PLUS. Make an Appointment. If you're. How do I open a joint savings account? Joint savings accounts must be opened at a branch. $10, to $24,; $25, to $49,; $50, to. Your best bet is in an online high-yield savings account, which pays more interest than a traditional savings account at your local brick-and-mortar bank. You can buy paper I bonds with your IRS tax refund. How does an I bond earn interest? I savings bonds earn interest monthly. Interest is compounded semiannually. If you decide to put your savings in a CD, test-driving this strategy with a one-year term could help you get a taste of what it's like to lock up your money. You can buy an electronic savings bond for any amount from $25 to $10, to the penny. For example, you could buy an electronic savings bond for $ In any. Automate your savings. It can be tempting to spend the money when it's in your checking account. · Avoid unsecured debt. · Invest early and often. · Don't leave. make, you should consider saving more. And if you have dependents or other How much interest would $10, earn in a savings account in a year? The. Your money can make an “income,” just like you. You can make more money when you and your money work. You buy something with your money that could in-. If a hard copy check is requested, a complete mailing address must also be provided. Make sure that your allotment has stopped before requesting withdrawal.

Best Buy Pay Credit

Use the My Best Buy ® Credit Card and earn rewards or tap into flexible financing. To pay your Best Buy credit card by phone, dial Ensure you have your account details and a valid check from a U.S. bank on hand when you call. Tapping to pay is faster than swiping or inserting your Card. Get points per $1 spent (5% back in rewards) on qualifying Best Buy purchases when you. payment methods (like credit cards) for a single order on Best Buy. PayPal Credit financing is not available for Best Buy purchases as of now. Late payment fee. Up to $ Terms apply. Pros. No. Were you looking for one of these? Manage your My Best Buy® Credit Card · Apply for the My Best Buy® Credit Card · Accepted payment. Call Have your account number and valid check from a U.S. bank ready when you call. There is no fee when you pay through our automated system. 1. Shop Online. Shop gorodkair.ru® and add items to your cart. Step 2 alt text · 2. Use your Citi® Card. At checkout, enter your eligible Citi credit card. Step 3. How do I pay my bill? · Online: Make a payment online or check your balance with your Citibank Account Online. · By phone: Call · By text: Text*. Use the My Best Buy ® Credit Card and earn rewards or tap into flexible financing. To pay your Best Buy credit card by phone, dial Ensure you have your account details and a valid check from a U.S. bank on hand when you call. Tapping to pay is faster than swiping or inserting your Card. Get points per $1 spent (5% back in rewards) on qualifying Best Buy purchases when you. payment methods (like credit cards) for a single order on Best Buy. PayPal Credit financing is not available for Best Buy purchases as of now. Late payment fee. Up to $ Terms apply. Pros. No. Were you looking for one of these? Manage your My Best Buy® Credit Card · Apply for the My Best Buy® Credit Card · Accepted payment. Call Have your account number and valid check from a U.S. bank ready when you call. There is no fee when you pay through our automated system. 1. Shop Online. Shop gorodkair.ru® and add items to your cart. Step 2 alt text · 2. Use your Citi® Card. At checkout, enter your eligible Citi credit card. Step 3. How do I pay my bill? · Online: Make a payment online or check your balance with your Citibank Account Online. · By phone: Call · By text: Text*.

During the promotional period for the special financing offer, Best Buy credit cardholders do not have to pay interest if they make their fixed monthly payments. pay it off slowly. Both of these options come with warnings. On the Comparing the My Best Buy Visa® Card With Other Credit Cards. Amazon Visa. Unfortunately, the answer is NO. Typically, store credit is meant for purchases of goods and services they offer, not for paying off credit. Shop for best buy credit card,~~ best buy credit card phone number at Best Buy. Find low everyday prices and buy. Online Bill Pay · Enrollment or Changing Bank Account · Payments · Same Day Crediting · Authorization. Through deferred financing, cardholders can pay off their purchases with no interest in a specific timeframe. Cardholders can go the traditional route and. The trick was the same as with all 0% financing credit card offers: you've gotta have it fully paid off by the end of the term, and if you don't. No Pay / Same As Cash. This plan is available to residents of Canada (excluding Quebec). On approved credit. Financing is provided by Fairstone Financial Inc. balance within the line of credit and within payment terms. If Accountholder's bank or Accountholder for any reason should fail to timely pay any amount due. Shop for best buy credit card app at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. gorodkair.ru accepts these payment types: · My Best Buy® Credit Card · My Best Buy Visa® Card · Best Buy Gift Cards · My Best Buy reward certificates · Visa. "~~ best buy credit card customer service" · Filter & Sort · Get it fast · Price · Brand · Features · Current Deals · Color. If you have the BB credit card and pay through the app, be REALLY CAREFUL not to tap on the 'make a payment' part UNLESS YOU REALLY PLAN TO PAY RIGHT THEN!! When you shop at Best Buy with Affirm, you'll never pay more than what you see up front. Unlike most credit cards, we charge simple interest, not compound. Yes, you can pay your credit card bill by cash or check in any Best Buy store. You also can pay online, by phone, or by mail. Call or email to reach a financial expert who can help you achieve your financial goals; whether that is finding ways to save money, lowering car loan payments. Select PayPal Credit at checkout to have the option to pay over time. Qualifying purchases could enjoy no Interest if paid in full in 6 months on purchases. Must select My Best Buy Credit Card as Payment at checkout. Subject to credit approval. Terms and conditions apply. In select stores. Online offer may vary. This credit card offers rewards on your purchases, but you will have to pay an annual fee of up to $59 for the privilege. Up to 5% balance transfer fee. My Best.